Investors of all kinds recognize and respect the way that precious metals can add security-enhancing diversity to just about any portfolio. Given that precious metals like gold tend to perform well even when other markets are down, having a position in such a commodity can easily turn out to be prudent.

There are also many different ways to invest into precious metals, each with its own particular advantages. For those who wish to enjoy the utmost in the security traditionally associated with precious metals, coin dealers like First Fidelity Reserve often have a great deal to offer.

The Tangible, Physical Security of Gold and Silver

While some investors go their entire lives without ever putting their savings toward anything concrete, there are good reasons to think about the alternative. Many investors believe, for example, that devoting at least some of their attention to real estate can easily pay off in a variety of important ways.

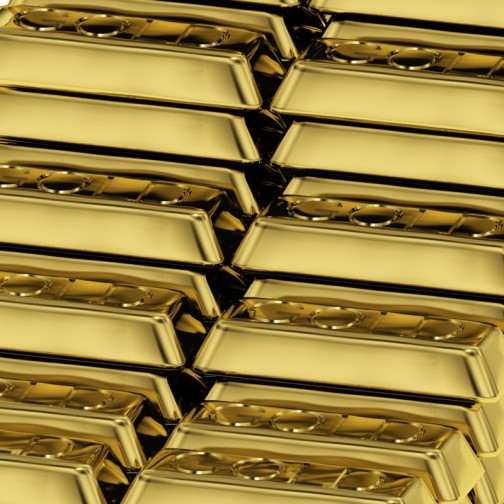

Gold and silver often make even more inviting candidates for this type of investment focus. While it is possible to invest in futures contracts that imply no need to ever take delivery, it is just as easy to acquire real, physical gold and silver bullion. For the many investors who value security significantly, that can be an easy decision to make.

The Right Dealer Makes Investing Even Easier and More Productive

Companies like First Fidelity Reserve are also ready to help investors make the most of this approach to the discipline. By offering up carefully selected inventories of gold and silver coins, they provide enough choices for any investor without imposing extraneous possibilities to work through.

Many investors, for instance, will find the American Eagle coins offered by such dealers to make for a perfect fit with their situations and goals. Produced and backed by the most respected source of all, these coins are regarded by many as the standard against which all other options must be measured.

Investors who find gold and silver to be appealing should therefore have no trouble following through on that inclination in ways that will benefit them as much as possible. With just about every investor being able to appreciate what precious metals have to offer, options like these are almost always worth investigating.